The Importance of Registering for Side Hustles (Lazada Affiliates, etc.)

Side hustles are a great way to supplement your income, and they’ve become more accessible than ever. With platforms like Lazada offering affiliate programs, you can earn commissions by simply sharing links and promo codes. However, to make the most of these opportunities, it’s important to stay prepared. Registering with the Bureau of Internal Revenue (BIR) allows you to legitimize your side hustles and unlock more flexibility to take on additional income streams.

To register with the BIR, you can ask for a guide from customercare@taxumo.com and handle it yourself or ask for one of our Taxumo CPA Partners to help you: Learn more here

Let’s dive into how you can handle your payouts and issue invoices as a Lazada Affiliate seamlessly using Taxumo.

Step 1: Understand Your Lazada Commissions

As Lazada Affiliates, you earn commissions when people use your links and codes to make purchases. These earnings will appear in your Conversion Report in the Lazada Affiliate Program Adsense dashboard (adsense.lazada.com.ph).

Step 2: Track Your Payout Threshold

Lazada only processes Lazada Affiliates payouts when your commission earnings reach the minimum threshold of Php 1,200. Once you hit this amount, you’ll receive a Payment Advice notification in your dashboard.

Step 3: Locate Your Payment Advice

To access your Payment Advice:

- Log in to your Lazada Affiliate Program Adsense dashboard (adsense.lazada.com.ph).

- Navigate to the Monthly Bill tab.

- Under the Payment Advice section, click on the details to review the breakdown of your earnings. This will help you understand exactly how much you’ve earned and ensure there are no discrepancies.

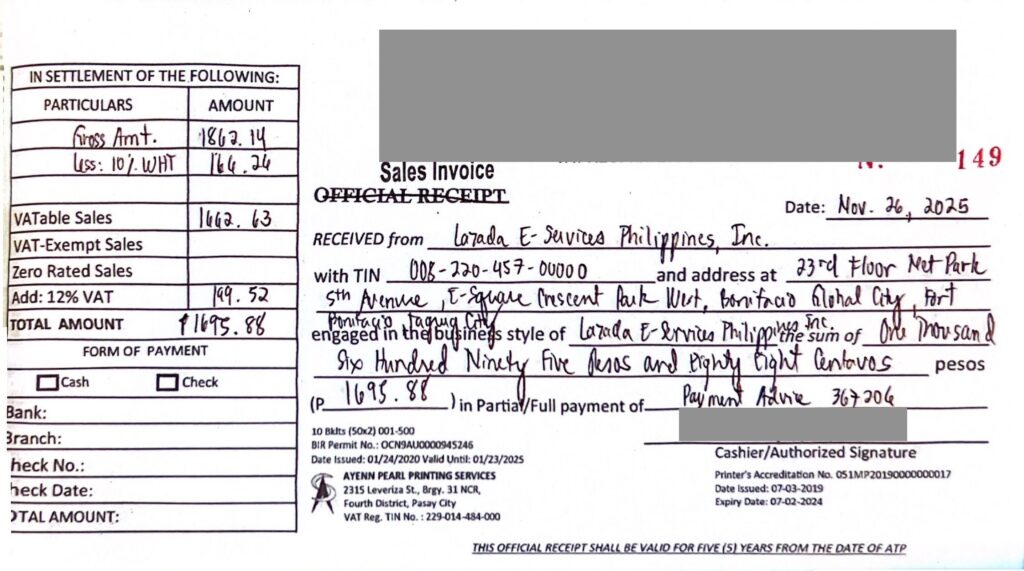

- You’ll need to upload a copy of your BIR registered invoice. This is how to write it. Note that the sample company is a VAT registered company.

Sample Payment Advice

Sample invoice issued out for this payment advice

For incorrect invoices, Lazada can reject the uploaded invoices and payout will only be done once the correctly filled out invoices are uploaded.

Some reminders:

- Use the correct details:

- Receive From: Lazada E-Services Philippines Inc.

- Vat TIN: 008-220-457-00000

- Address: 23rd Floor Net Park 5th Avenue, E-Square Crescent Park West, Bonifacio Global City, Fort Bonifacio, Taguig City

- Business Style: Lazada E-Services Philippines Inc.

- Date: Date of Invoice

- Make sure that the correct values are placed in proper fields in your BIR Invoice. A breakdown like the sample above is necessary.

- Make sure that if you are still using an “official receipt” to cross it out and stamped with Service or Sales Invoice. Complete guide here: https://www.taxumo.com/blog/bir-rules-on-receipts-transitioning-to-invoices/

- Make sure that you also send the original, hard copy of your BIR invoice to:

Step 4: Easy tax filing via Taxumo

Once affiliate commission is credited to your bank account, you will see a payment completed status on your Lazada Affiliate Dashboard.

Now, how do you file taxes? Do you have to file taxes?

The answer is yes! The withheld taxes that Lazada Affiliates deducted from your payout commission is ONLY A PORTION OF THE TAXES that you need to pay. Lazada will give you a copy of a form 2307, which is a proof that they remitted these withheld taxes to the BIR. You will then use these form 2307s when you file your income tax.

How is that? Is it difficult?

Not really… All you need to do is log the same information in your Taxumo account.

- Sign up for FREE to Taxumo and fill up your Settings page (if you have questions, you can send an email to customercare@taxumo.com) We have a guide here too: https://www.taxumo.com/blog/how-to-update-profile-taxumo/

- Click on Cashflow and then click on ADD button near Total Sales / Revenue

3. Based on the information above in the sample invoice, enter the details like this in Taxumo:

*No need to upload a copy of your invoice (this field is optional)

4. Also, once you have your 2307 form, go Taxes >> Withheld Tax >> Received. Then click on ADD RECORD.

5. Copy the information in your 2307 to the fields shown. Also upload a digital copy of the signed 2307.

After encoding all of the information mentioned above, check your tax dues tab if there are any taxes that you need to file and pay for. Each tax form is shown as one box and the due date is also indicated.

What’s cool about Taxumo is that whenever your input / encode your Lazada affiliate earnings or any other earnings, the tax dues seen in the boxes adjust automatically to how much taxes you need to pay.

To sign up as a Lazada Affiliate, you can go to this link: Sign up as a Lazada Affiliate

Final Thoughts

Joining affiliate programs like Lazada’s can be an excellent way to grow your income, but don’t overlook the importance of proper registration and tax compliance. With tools like Taxumo, managing your payouts and invoices becomes a breeze, leaving you more time to focus on growing your side hustle. Ready to take the next step? Start your Taxumo journey today and unlock the full potential of your earnings!

Hi! paano po ang magiging entry nito sa manual book of accounts? (cash receipts/disbursement) Thanks!

Hi Summer! In Taxumo, you can check your Books tab under the “Taxes” tab and then export nyo lang yung report. Literally, copy nyo lang yung report sa mga books nyo po. If you have any questions, reach out to our Customer Care Team via Taxumo Facebook page 🙂