Starting your business journey? Wondering on what to begin with when you want to pay taxes? Whether you’re a freelancer, a sole proprietor, or starting a corporation, getting your COR (Certificate of Registration) is one of the first—and most important—steps you need to complete.

In this guide, we’ll walk you through how to get COR from the BIR in 2025, including the requirements, step-by-step process, and some tips to make the experience smoother.

What is a COR (Certificate of Registration)?

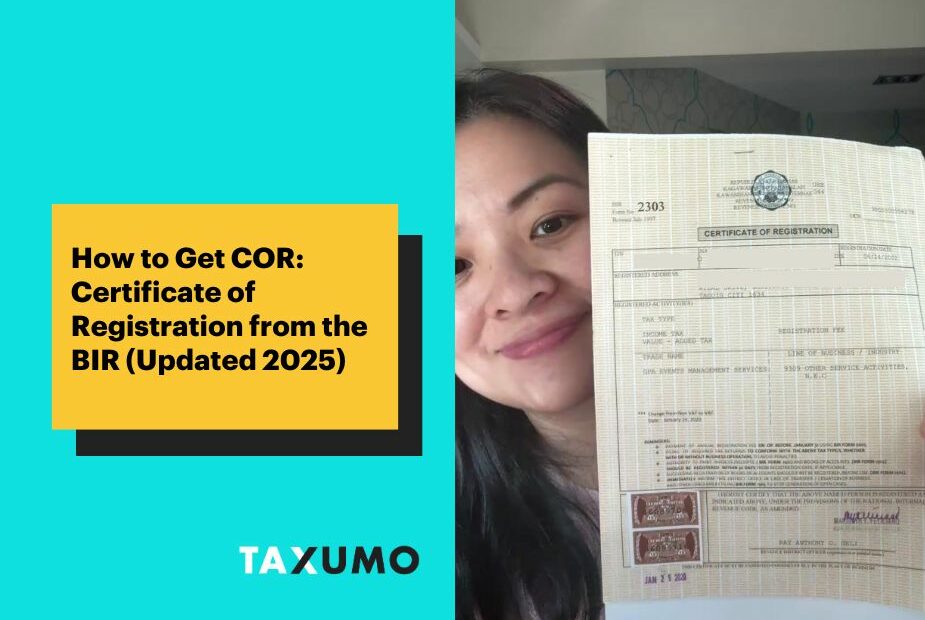

The Certificate of Registration (Form 2303) is an official document issued by the Bureau of Internal Revenue (BIR). It proves that you are registered as a taxpayer—either as an individual, professional, business owner, or corporation—and are authorized to issue official receipts (ORs) or sales invoices. Usually, to simplify things, I would normally explain it to be your “profile” with the BIR. It contains details about your business and the types of taxes that you need to pay. It’s a public document that needs to be shown to your customers actually. The BIR asks you to post this in your store front. Customers can actually ask for a copy if they need it, and you should be able to send it to them. Customers or clients who withhold from payments normally ask for a copy of your 2303 to know what kind of a business you are so they can use the appropriate ATC or Alpha Numeric Tax Code when they withhold from your payment (withholding tax is another story so read more about it here in Taxumo’s blog).

Without a COR, you cannot legally operate your business in the Philippines.

Who Needs to Get a COR?

You need to know how to get COR if you are:

- A freelancer or self-employed professional

- A mixed income earner, meaning even if you have a day job, you are running a business on the side or you have a freelancing career (ex. content creator, VA, artist, trainer, etc.)

- A sole proprietor business owner

- A corporation, partnership, or cooperative

- A lessor (earning rental income)

- A foreign individual earning income in the Philippines

- Anyone planning to operate any income-generating activity legally

How to Get COR: Requirements (2025 Updated List)

Before going to the BIR, make sure you prepare the following documents:

- Fully Accomplished BIR Form 1901 (for individuals) or BIR Form 1903 (for corporations)

- Valid government-issued ID (photocopy and bring the original)

- Proof of Address:

- Barangay Certificate or

- Lease Contract if renting, or

- Proof of ownership if you own the place

- Birth Certificate (in some cases for sole proprietors)

- DTI Business Name Certificate (for sole props) OR SEC Certificate of Incorporation (for corporations): No need if registering as a professional

- Payment of Registration Fee: ₱500 (via BIR Payment Form 0605)

- Documentary Stamp Tax Payment: ₱30 (for COR issuance)

- Books of Accounts to register (ledger, journal, etc.): Buy around 4-6 pieces of Eight or twelve columns Columnar ledgers

Tip: Some RDOs (Revenue District Offices) now require an “Email Address and Mobile Number Form.” It’s best to call your RDO before visiting.

Step-by-Step: How to Get COR in 2025

Here’s your easy-to-follow checklist on how to get COR:

Step 1: Identify your RDO

Find out which Revenue District Office (RDO) has jurisdiction over your home address or business address.

👉 If you’re not sure, you can inquire at the nearest BIR office or use the BIR website’s Revie.

Step 2: Complete and Prepare All Required Documents

Fill out BIR Form 1901 or 1903 properly. Make photocopies of all supporting documents and bring the originals for verification.

Step 3: Pay the Registration Fee and Documentary Stamp Tax

- Go to any Authorized Agent Bank (AAB) of your RDO, or use BIR’s electronic payment channels.

- Pay ₱500 for the registration fee (using BIR Form 0605).

- Pay ₱30 for the documentary stamp tax.

Note: Some BIR offices now accept online payment via Landbank Link.Biz or GCash.

Step 4: Submit Documents at Your Assigned RDO

- Submit your documents at the New Business Registrant Counter.

- They will check your documents and payments.

- Some RDOs might require you to attend a short briefing (Taxpayer’s Orientation Seminar).

Step 5: Get Your COR (Form 2303)

Once everything is complete, you will be issued your Certificate of Registration (Form 2303).

🎉 Congratulations! You are now officially registered with the BIR.

After You Get Your COR: What’s Next?

✅ Register Your Books of Accounts — Have your ledgers, journals, and cash receipts books stamped at the RDO.

✅ Apply for Authority to Print (ATP) — If you need to issue official receipts or invoices, you must get an Authority to Print from BIR and have your OR books printed by an accredited printer.

✅ Start Filing Your Taxes — Make sure to file and pay your taxes properly. Platforms like Taxumo make it easy for freelancers, small business owners, and professionals to comply with their tax obligations online!

FAQs on How to Get COR

1. Can I apply for a COR online?

As of 2025, the BIR opened up ORUS so that you can register through this facility too. Know how to register and get access to ORUS here: https://www.taxumo.com/blog/how-to-register-at-orus-bir-gov-ph-a-step-by-step-guide/

2. How long does it take to get my COR?

If your documents are complete, it can take 1 to 2 business days. Some RDOs even release the COR on the same day.

3. What if I fail to register my business?

Operating without a COR can result in penalties, closure orders, and compounded fines from the BIR.

Knowing how to get COR is crucial for starting your business legally and smoothly in the Philippines. While the process may seem tedious at first, it’s very manageable with the right preparation.

If you want to make tax compliance stress-free after registering, consider signing up for Taxumo—the Philippines’ leading online tax compliance platform!

Pingback: Taxes for Freelancers in the Philippines 2025: Complete Guide

Pingback: How to Start a Side Hustle in the Philippines (2025 Guide for Moms)

Hi I just want to ask if I need a business permit to get a Certificate of Registration (COR)? Thank you!

Hi Greg,

Yes in order to get a Certificate of Registration, you need to undergo the process of getting business permits from LGU.

If you need any assistance, feel free to check out our services for business registration here: https://marketplace.taxumo.com