Taxes are the lifeblood of the State, empowering the government and its agencies to operate effectively and fulfill their responsibilities for the welfare of the people. In essence, the system of taxation embodies the principle of reciprocity: what the citizen contributes through taxes is reinvested to improve society. As the Court aptly stated in CIR v. Algue, “Taxes are what we pay for a civilized society. Without taxes, the State would be paralyzed.”

This article provides a comprehensive overview of Value-Added Tax (VAT), a business tax that every business owner should understand.

What is Value-Added Tax?

Value Added Tax (VAT) is a tax on consumption levied on the sale, barter, exchange or lease of goods or properties and services in the Philippines and on importation of goods into the Philippines. Conversely, any sale, barter, or exchange of goods or services in the regular conduct or pursuit of a commercial or an economic activity.

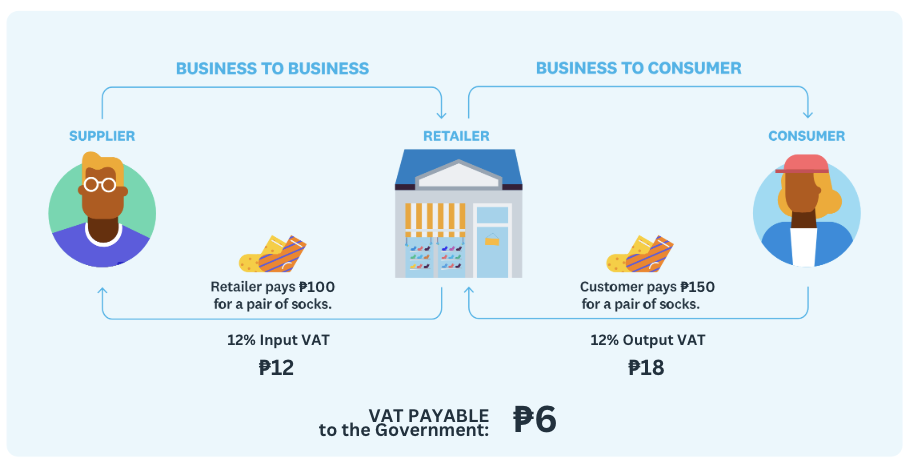

This tax is imposed on the “value added” by the taxpayer in the course of a business transaction. The value added represents the difference between the taxpayer’s total sales and total purchases over a specific period. Unlike income tax, which is based on taxable gains, this tax targets the value added at each stage of the transaction, from the labor and raw materials to the sale of the final product.

In the Philippines, the rate of VAT is 12% on the gross selling price or gross value in money of the goods or properties sold, bartered, or exchanged, such tax to be paid by the seller or transferor. The value of goods or properties sold and subsequently returned or for which allowances were granted by a VAT-registered person may be deducted from the gross sales for the quarter in which a refund is made or a credit memorandum or refund is issued. Sales discount granted and indicated in the invoice at the time of sale and the grant of which does not depend upon the happening of a future event may be excluded from the gross sales within the same quarter it was given.

Transactions Subject to VAT

A taxable sale refers to any sale, trade, exchange, or lease of goods, properties, or services that is subject to Value-Added Tax (VAT). Certain business transactions are also classified as “deemed sales,” where goods or services are considered sold for tax purposes even if no actual sale occurs. For example, if a business owner takes inventory items meant for sale and uses them for personal purposes, this is treated as a taxable transaction.

Taxable sales also include the importation of goods. Every importation is subject to VAT, regardless of whether the goods are used for business purposes or not.

To be considered a Taxable Sale, it must meet the following conditions:

- It must be a regular business activity: The transaction must arise from a regular commercial or economic activity conducted in the ordinary course of trade or business. This includes activities incidental to business operations, but excludes isolated transactions. Taxable Sale requires repetition and continuity of action.

- It must be completed in the Philippines: The transaction must involve the sale, barter, exchange, or lease of goods or properties, or the provision of services within the Philippines. Additionally, the transaction must have monetary value.

- It is not VAT-Exempt: If the law specifically exempts a transaction from VAT, then it won’t be taxed under VAT, but other taxes might still apply.

If all three conditions are met, the business transaction is subject to a 12% VAT. Otherwise, the seller is not liable for VAT. Nonetheless, although already subject to VAT, it does not necessarily follow that the taxpayer is exempt from paying other applicable taxes.

VAT vs. Sales Tax: Key Differences

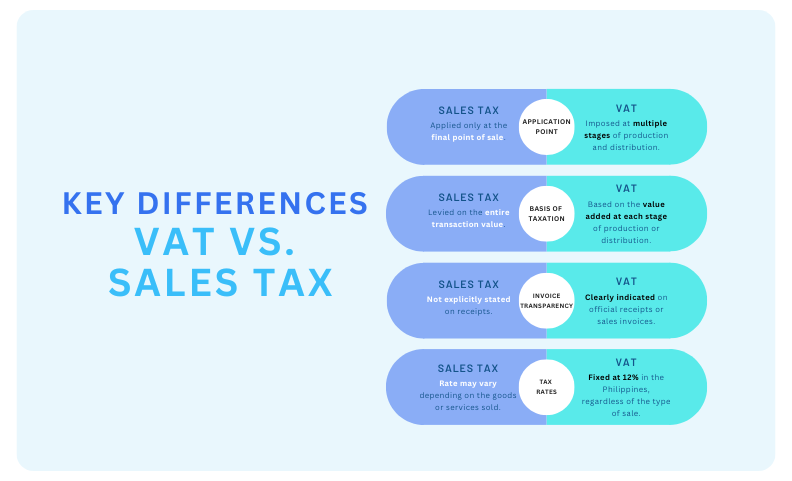

Both VAT and Sales Tax applies to the taxable sale, barter, or exchange of goods, properties, or services, whether actual sale, deemed sale, export sale, or local sale. However, it is important to distinguish between sales tax and Value-Added Tax (VAT), as they differ despite some similarities.

Sales tax is charged only when a product is sold to the final customer, while Value-Added Tax (VAT) is applied at every step of the supply chain—from production to distribution—whenever value is added to the product. With VAT, businesses pay tax when they buy materials and also collect tax when they sell products, but they can deduct the tax they already paid.

VAT is always included in the price, and businesses must show it clearly on receipts or invoices. In the end, whether it’s sales tax or VAT, the final cost is passed on to the consumer, meaning the buyer ultimately pays the tax.

Lastly, the rate for sales tax may vary depending on the nature of the goods or services sold, whereas VAT in the Philippines is fixed at 12% regardless of the type of sale.

Who is Liable for VAT?

By its nature, VAT is an indirect tax, with the ultimate burden falling on the final consumers. The seller is statutorily responsible for the payment of VAT; however, the tax amount can be shifted or passed on to the buyer, transferee, or lessee of the goods, properties, or services. In the case of importation, the importer bears the liability for VAT.

A taxpayer liable for VAT can be either a natural person or a juridical entity, regardless of whether they are a non-stock, non-profit private organization (irrespective of how their net income is utilized or whether they sell exclusively to members) or a government entity.

Note: The individual who bears the tax burden is not necessarily the one directly responsible for paying or transferring the tax amount. To put it simply, the final consumer ultimately bears the tax burden and pays the VAT through the purchase price, while the seller acts as an intermediary, collecting the tax and remitting it to the State.

Who is not liable for VAT?

Although still considered transactions subject to VAT, export sales and sales to persons or entities exempt under special laws or international agreements to which the Philippines is a signatory are subject to a 0% rate (i.e. zero-rated and effectively zero-rated transactions). This treatment is adopted to exempt the transaction completely from VAT previously collected since input taxes passed on may be recovered as refunds or credits by the supposed taxpayer.

Section 109 of the Tax Code provides the sales and services which are exempt from VAT or transactions which are not subject to VAT, these include:

- Sale or Importation of Essential Goods & Agriculture (e.g. fruits, vegetables, meat, fish in their natural state; Livestock and poultry used for food; Fertilizers, seeds, seedlings, and feeds for animals)

- Imports for Personal Use (e.g. Tools and equipment used for work or profession; Personal belongings of overseas Filipinos moving back)

- Essential Services (e.g. Educational services from DepEd, CHED, TESDA-accredited schools and government schools)

- Housing & Real Estate (e.g. Low-cost and socialized housing; Sale of real estate that is not for business resale or rental)

- Special Groups & Agreements (e.g. Sales or leases to senior citizens and persons with disabilities (PWDs) as per law)

Tax Compliance: Required Forms and Payment

In general, VAT operates on a system where input VAT (tax paid on purchases) can be credited against output VAT (tax collected on sales). If output VAT exceeds input VAT, the excess is paid to the government. If input VAT exceeds output VAT, the excess can be carried forward to future periods or, in some cases, refunded. This system ensures that the tax burden is distributed throughout the supply chain, allowing each participant to recover the VAT paid on inputs. As a result, VAT is not a final tax for most businesses involved in the process.

Registration

Businesses and individuals must register for VAT and file VAT returns if they fall under these categories:

- VAT-Registered Businesses – Companies or individuals selling goods, properties, or services with total yearly sales of ₱3,000,000 or more.

- Voluntary VAT Registrants – Businesses earning less than ₱3,000,000 per year but choose to register for VAT.

- Importers – Anyone who imports goods, regardless of income level.

Note: In the Philippines, Companies with actual gross sales or receipts of less than ₱3,000,000 are exempt from registering and filing for VAT.

VAT Taxpayers are required to register with the Bureau of Internal Revenue (BIR) and pay an annual registration fee of ₱500 for each separate and distinct establishment, including any facilities where the business operates. They must complete and submit BIR Form 1903 or 1905 to their local Revenue District Office (RDO) to obtain a Tax Identification Number (TIN). Once registered, they will receive a Certificate of Registration (Form 2303), which specifies the taxes they must pay.

If a person or business required to register fails to do so, they will be liable to pay VAT as though they were VAT-registered, but without the benefit of tax deductions (i.e. input tax credits).

Invoicing Requirements

A VAT-registered person is required to issue a VAT Invoice for any sale or exchange of goods or properties for value, and a VAT Official Receipt for leasing of goods or properties, as well as selling services.

The VAT invoice or official receipt must include the following details:

- Seller Information (i.e. that he/she is a VAT-registered person, and seller’s TIN)

- Payment and VAT Breakdown

Note: For transactions specifically classified under the law, such classification must be prominently displayed in the Invoice or Receipt – such that it must indicate the term “VAT-Exempt Sale” or “Zero-Rated Sale”.

- Transaction Details (e.g. transaction date, quantity, unit cost, and description of the goods or properties, or the nature of the service)

- Purchaser Information, if available.

Note: A non-VAT registered person who issues a VAT invoice/receipt shall be held liable for Payment of percentage tax if applicable; Payment of VAT without input tax; and 50% surcharge on tax due. Meanwhile, in case a VAT-registered person issues a VAT invoice/official receipt for a VAT-exempt sale without the words “VAT Exempt Sale,” the transaction shall become taxable and the issuer shall be liable to pay VAT thereon. The purchaser shall be entitled to claim an input tax credit on his purchase.

Accounting Requirements

All persons subject to the VAT shall, in addition to the regular accounting records required, maintain a subsidiary sales journal and subsidiary purchase journal on which the daily sales and purchases are recorded.

Conclusion

The standard 12% VAT applies to most services, imports, and transactions involving the sale, exchange, barter, or lease of goods or properties. Navigating the compliance requirements can be challenging, as they are governed not only by the tax code but also by various BIR circulars and issuances. Staying updated on these regulations is essential for business owners to ensure accurate tax payments, avoid unnecessary penalties, and maintain smooth business operations.