The 2303 BIR Form, also known as the Certificate of Registration (COR), is a vital document issued by the Bureau of Internal Revenue (BIR) in the Philippines. This document officially registers an individual or entity as a taxpayer, outlining key tax obligations and serving as proof of compliance with government regulations.

Who needs to have a 2303 BIR Form or a Certificate of Registration?

All types of business entities or professionals earning income outside “employment” — whether sole proprietorships, partnerships, corporations, or others—are required to register with the Bureau of Internal Revenue (BIR). This is not only a legal obligation but also a key step toward building trust, streamlining operations, and fostering growth opportunities.

Professionals and Freelancers

Professionals and freelancers operate independently, earning income by providing specialized services. This group includes licensed practitioners like doctors and lawyers, as well as freelancers like virtual assistants, writers, graphic designers, athletes and consultants. They are also required to register with the BIR to legitimize their operations.

Sole Proprietorships

Sole proprietorships are the simplest form of business, owned and operated by one individual. The owner enjoys full control over the business and retains all profits but is also personally responsible for any losses, debts, or liabilities incurred.

Partnerships

Partnerships involve two or more individuals or entities working together by pooling their resources and sharing responsibilities. Partners divide the gains and losses according to their agreement, making this structure ideal for collaborative ventures.

Corporation

Corporations are distinct legal entities separate from their owners, providing limited liability protection to shareholders. However, they must adhere to strict regulatory requirements, including financial reporting and compliance with corporate laws, making them more structured and complex.

One Person Corporations (OPCs)

One Person Corporations offer a unique balance of simplicity and limited liability. Owned by a single individual, OPCs provide the protection of a corporation without the need for multiple shareholders, making them an attractive option for solo entrepreneurs.

Cooperatives

Cooperatives are community-driven organizations formed by individuals sharing a common goal. Members jointly own and democratically manage the enterprise to meet economic, social, or cultural objectives, promoting shared benefits and collective responsibility.

By understanding these different types of business structures and their specific requirements, taxpayers can ensure they comply with BIR regulations, build credibility, and position themselves for sustainable success. As a starting business owner, this is the first thing that you would need to decide on.

What’s next?

The next part is to register with the different government agencies to form your chosen structure. If you need help with registration, check out our registration services here: https://marketplace.taxumo.com/

One thing that is constantly present in the process though is securing a 2303 BIR Form or a Certificate of Registration from the BIR.

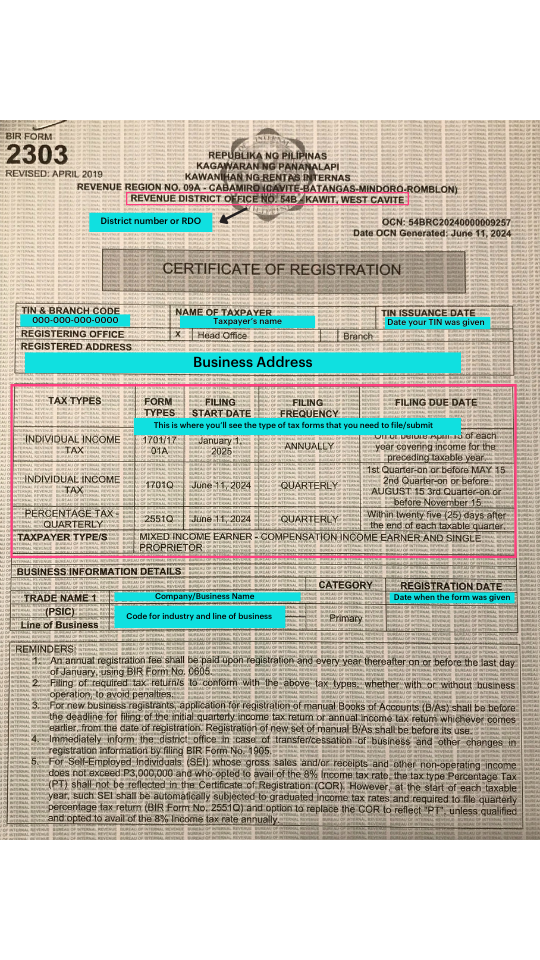

Key Parts of the 2303 BIR Form

To better understand this document, let’s break down its key components:

- TIN (Tax Identification Number): Located at the top left of the form, the TIN is a unique identifier assigned to every taxpayer. This number is crucial for all tax-related transactions.

- Revenue District Office (RDO) Code: The RDO code specifies the BIR office where the taxpayer is registered. This is important for determining where to file taxes or address inquiries.

- Taxpayer’s Name: This section displays the individual or business entity’s registered name, ensuring their identity is officially recorded.

- Business Address: The address listed here is the official location where the taxpayer operates or can be reached for BIR-related matters.

- Tax Types and Forms: This area indicates the types of taxes the taxpayer is required to file, such as Income Tax or Percentage Tax, as well as the corresponding forms (e.g., BIR Form 1701 or 2551Q).

- Line of Business/Industry Code: This part provides the registered business activity or industry code. For example, 9309 Other Service Activities, N.E.C. reflects a specific business category.

- Registration Date: The date listed here marks when the TIN and registration were officially issued by the BIR.

- Trade Name: For businesses, this section indicates the registered trade name, if applicable.

- Reminders: This section outlines essential compliance reminders, such as: Filing required tax returns on time to avoid penalties, registering official receipts and books of accounts within 30 days of issuance, etc.

Why is the 2303 BIR Form Important?

The 2303 BIR Form is more than just a registration document—it is a legal requirement for businesses and professionals in the Philippines. Here are some reasons why it’s essential:

- Proof of Registration: It certifies your status as a legitimate taxpayer.

- Compliance with Tax Laws: It details your tax obligations, ensuring you know what to file and when.

- Basis for Other Registrations: It is often required when applying for business permits, opening a bank account, or securing government clearances.

How to Secure a 2303 BIR Form?

If you’re looking to get your 2303 BIR Form, follow these steps:

- Visit your designated Revenue District Office (RDO).

- Complete the application for a TIN and submit required documents, such as a valid ID, proof of address, and business registration papers (if applicable).

- Pay the registration fee and attend the taxpayer briefing, if required.

- Wait for your Certificate of Registration to be issued.

Final Thoughts on the 2303 BIR Form

The 2303 BIR Form is an indispensable document for individuals and businesses operating in the Philippines. Understanding its components and significance will help you stay compliant with tax laws and avoid unnecessary penalties. Whether you’re a freelancer, entrepreneur, or corporation, securing and maintaining your Certificate of Registration is a vital step toward legitimate operations in the country.

To file an Income Tax Return form, make sure you are registered and have a COR.

This coming April 2025, here is a useful article on Annual Income Tax Filing: https://www.taxumo.com/blog/how-do-i-file-an-annual-income-tax-return/

Hi Sir/Mam, I would like to seek assistance from your side. I’m a retired employee and would like to apply as seller in Shoppe/Lazada to support my 8 yr. old son. As new on this online selling platform, do I need to register in BIR. If online selling is not performing well, do I need to pay?

Hi Mariano!

Online sellers on Lazada and Shopee are now required to get their BIR registration. If you’re not yet earning a significant amount from your online sales, you can still file your taxes but won’t need to pay anything if your income doesn’t exceed the tax payable threshold.

How is the cost of certificate of registration 2303

The cost of business registration with the BIR (Certificate of Registration – BIR Form 2303) depends on the type of business and additional fees required. Here’s a general breakdown:

Estimated Cost of BIR Business Registration

📌 Documentary Stamp Tax (DST) on COR: ₱30

📌 Books of Accounts (varies, est.): ₱500

📌 Printing of Official Receipts/Invoices: ₱1,500 – ₱3,500

📌 Notarial Fees for Application Forms: ₱200 – ₱500

💰 Estimated Total Cost: ₱2,500 – ₱6,000, depending on required receipts and processing fees.

If you need help, check out our business registration services here: https://marketplace.taxumo.com/

Hi. Is form 2303 automatically be updated once tax exemption for cooperative is released? Or do we still have to ask BIR to update it?

Hi Bliss! For this, might be best to get a consult session with one of our CPA partners. 🙂 They would be the best people to guide you on this.

Hello. I have a BIR-registered online store, i am selling on e-platforms. I would just like to ask if I want to do online ticketing (airlines), do I need to update my COR, or I can still use my existing registration? Thank you so much.

Hi Xhen! It’s best to ask your RDO about this. 🙂

What to use in case of payment to individual? BIR 2303 is under the name of the Taxpayer and the Trade name is different.

Hello ma’am, I’m an employee in the government – to a State University to be specific. Do our University need to have this Form 2303 or are we exempted to this? Or if not, how do we secure it? Some other govnt offices like GSIS are asking this document from us. Thank you

Hello. I wanna ask some questions regarding the BIR registration. So, I already registered to bir last March 26, 2025 with no sales in March. Based from my COR, it says there the start filing date is April 1, 2025. Should I still do the filing for the March and 1st Quarter Returns? Is there in any revenue issuances regarding this matter?

Thank you. Your answer will be appreciated.