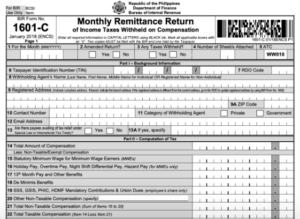

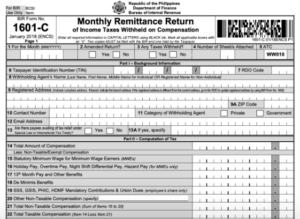

For compensation paid January–November: file and remit by the 10th day of the following month.

For December compensation: extended deadline into January of the next year (e.g. January 13‑15 depending on filing group via eFPS; manual filers by January 15)