How to get your BIR Form 2303 And who needs to claim it?

Are you starting a business or practicing a profession in the Philippines? One of the tasks you’ll have to handle is getting yourself registered with the Bureau of Internal Revenue (BIR) and securing your Certificate of Registration (COR). This document is essential to ensure tax compliance and to avoid penalties.

We’ll walk you through everything you need to know about COR, including how to get it, why it’s important, and what happens next.

Don’t have time to process your COR for BIR?

Taxumo can help you register!

*To get your COR, you first need to register as a Sole Proprietor, Professional, or Corporation, depending on your taxpayer profile. For questions, email us at customercare@taxumo.com

What is the BIR Form 2303 (BIR Certificate of Registration)?

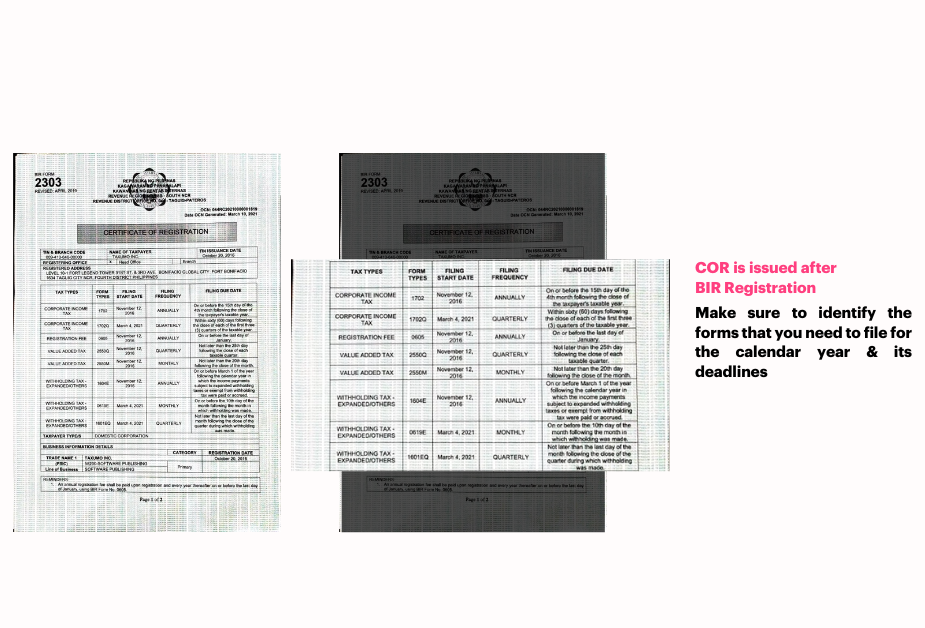

The BIR Certificate of Registration, commonly known as the COR or BIR Form 2303, is an official document issued by the Bureau of Internal Revenue. Registration proves that your business or practice is tax-registered. The COR outlines your tax obligations, including the types of taxes you need to pay (like income tax, value-added tax, or percentage tax) and your filing deadlines.

Why Do You Need It?

Obtaining a COR is not just a bureaucratic step—it’s a legal requirement. Here’s why it’s important:

- Legal Compliance: CORs are required by law and operating without one can result in heavy fines or the closure of a business.

- Transparency: This proves to your clients, customers, and suppliers that you are a legitimate, tax-compliant business.

- Financial Transactions: For business accounts or loan applications, banks and other financial institutions often require CORs.

- Government Contracts:Bidding on government projects usually requires a COR.

- Issuing Invoices: Once you have the COR, you can issue invoices that have been

Steps to Apply for a BIR Form 2303

Getting your COR might seem difficult to deal with, but it’s manageable if you know the steps. Here’s a simplified guide:

- Prepare Necessary Documents:

- For Sole Proprietors:

- DTI Business Name Registration Certificate

- Valid ID and TIN (Tax Identification Number)

- Barangay Clearance and Mayor’s Permit

- For Corporations or Partnerships:

- SEC Registration

- Articles of Incorporation or Partnership

- Corporate TIN

- For Sole Proprietors:

- Fill Out BIR Forms:

- BIR Form 1901 for self-employed individuals and professionals

- BIR Form 1903 for corporations and partnerships

- Submit Documents to Your RDO:

- Visit the Revenue District Office (RDO) where your business is located and submit the completed forms along with the required documents.

- Attend the Tax Briefing:

- Some RDOs require you to attend a taxpayer’s initial briefing to understand your tax obligations better.

- Claim Your COR:

- After processing, you’ll receive your COR (Form 2303) and “Ask for Receipt” notice, which you should display prominently at your place of business.

How Taxumo Makes the COR Process Easier

Navigating tax registration can be overwhelming, but services like Taxumo are here to help. Here’s how Taxumo simplifies the process:

- Easy Application: Taxumo guides and helps you through the entire registration process with step-by-step instructions.

- Expert Support: Access to tax professionals who can answer your questions and provide personalized advice.

- Time-Saving: By streamlining the process, Taxumo saves you time so you can focus on starting your business.

- Automated Filing: Once registered, Taxumo can also assist with your monthly and quarterly tax filings, making compliance easier.

What Happens After You Receive Your COR?

Congratulations on getting your COR! But your responsibilities don’t end here. Here’s what to do next:

- Print Invoices:

- Secure an Authority to Print (ATP) from the BIR and engage an accredited printer to produce your invoices.

- Maintain Books of Accounts:

- Register your books of accounts, such as journals and ledgers, with the BIR.

- Keep them updated as part of your compliance.

- File and Pay Taxes Regularly:

- Be mindful of your tax deadlines to avoid penalties.

- Use platforms like Taxumo to automate tax calculations and filings.

- Stay Informed:

- Tax laws and regulations can change. Keep yourself updated to remain compliant.

Feel free to share your experiences or ask questions in the comments below. We’re here to help you navigate your tax journey every step of the way. Happy registering!

Link about BIR Registration Certificate I can fill out now I need it for business affiliate

Hi Joan!

You can check out our services to help you register your business and get your COR. Visit our page here: https://marketplace.taxumo.com/.

Make sure to choose whether you’ll be registering as a sole proprietor or professional

i need may COR

Hi Avila,

Click this link here: https://marketplace.taxumo.com/ to register your business and get your BIR Registration Certificate.

Make sure po to identify whether you’ll be registering your business as sole-proprietor or corporation. Para po sa ibang katanungan mag email lang po at customercare@taxumo.com

How to get COR

Hi Cherry!

You can check out our services to help you register your business and get your COR. Visit our page here: https://marketplace.taxumo.com/.

Make sure to choose whether you’ll be registering as a sole proprietor, professional, or corporation.

Hi how to register for BIR for TikTok affiliate

Hi Rose!

You can find our available services to register here: https://marketplace.taxumo.com/products/registersolepro

If you have further questions, kindly message us through our chatbox (which can be found at the bottom right of the screen) or email us at customercare@taxumo.com

Please guide me on my bir /cor for my business thank you

Hi Laila!

You can check out our services to help you register your business and get your COR. Visit our page here: https://marketplace.taxumo.com/.

Make sure to choose whether you’ll be registering as a sole proprietor, professional, or corporation.

Can i register my business at BIR while still processing my business permit

Hi Diana,

We recommend getting all of your business permits with LGU before proceeding to BIR Registration. If you need help with BIR Registration, we have accountants that could help you with the process. Check it here: https://marketplace.taxumo.com

Make sure to identify if you’re going to register as a sole-prop, professionl, or a corporation 🙂

guide me please

Hi Louie,

Click this link here: https://marketplace.taxumo.com/ to register your business and get your BIR Registration Certificate.

Make sure po to identify whether you’ll be registering your business as sole-proprietor or corporation. Para po sa ibang katanungan mag email lang po at customercare@taxumo.com

How to apply or to get Certificate of Registration online?

Hi Lucy,

You can check our services here https://marketplace.taxumo.com/ to help you register your business and get your COR.

Make sure to choose whether you’ll be registering as a sole proprietor, professional, or corporation with BIR.

Hi just want to ask if I need to have BIR 2303 for professional service (example: dj service)?

Hi Mark,

Yes you will need to have FORM 2303 in order for you to operate your DJ Services. Your tax category might depend on how much you’re earning within a calendar year. But if you’re earning less than 3M, you can consider applying for professional or sole proprietor

We have services to help you register your business and get your COR. Visit our page here: https://marketplace.taxumo.com/.

Make sure to choose whether you’ll be registering as a sole proprietor or professional. If you have any questions, feel free to chat us on our chatbot as seen on https://www.taxumo.com

I am planning to start online dealership business. Since I do not have a physical store, can I still apply for COR

Hi Bella,

Yes you can definitely apply for a COR even if you don’t have a physical store. You can apply your business as an Online store.

Click this link here: https://marketplace.taxumo.com/ to register your business and get your BIR Registration Certificate.

Make sure po to identify whether you’ll be registering your business as sole-proprietor or corporation. Para po sa ibang katanungan mag email lang po at customercare@taxumo.com

Hi.

I need to get form 2303 for me to be qualified as tiktok affiliate

Hi Cherry!

Please check our services here https://marketplace.taxumo.com/ to help you register your business and get your COR.

Make sure to choose whether you’ll be registering as a sole proprietor, professional, or corporation.

Link about BIR Registration Certificate I can fill out now I need it for business affiliate

Hi Girlie,

Click this link here: https://marketplace.taxumo.com/ to register your business and get your BIR Registration Certificate.

Make sure po to identify whether you’ll be registering your business as sole-proprietor or corporation. Para po sa ibang katanungan mag email lang po at customercare@taxumo.com

I need register to BIR 2303

Hi Rolly,

Click this link here: https://marketplace.taxumo.com/ to register your business and get your BIR Registration Certificate.

Make sure po to identify whether you’ll be registering your business as sole-proprietor or corporation. Para po sa ibang katanungan mag email lang po at customercare@taxumo.com

Please register my business

Hi Abigail,

Click this link here: https://marketplace.taxumo.com/ to register your business and get your BIR Registration Certificate.

Make sure po to identify whether you’ll be registering your business as sole-proprietor or corporation. Para po sa ibang katanungan mag email lang po at customercare@taxumo.com

HI , as a cross-boarder seller located in China, do I have to get COR certificate before I can sell on Shopee and Lazada? I noticed that something called RR 15-2024 was published and I am really confused.

Hi Alvin,

Yes, e-commerce platforms now require their sellers to get registered with LGU and BIR.

We highly encourage to have your business be registered.

You can check our services here https://marketplace.taxumo.com/ to help you register your business and get your COR.

Make sure to choose whether you’ll be registering as a sole proprietor, professional, or corporation with BIR.

How to get my BIR or my COR

You’ll need to apply to get a COR. We have registration services here: https://marketplace.taxumo.com/